Are you a college student or recent graduate looking for help with student loan repayment? If so, you may have heard of Public Service Loan Forgiveness (PSLF), but do not know exactly how it works.

Don’t worry – this guide is here to help!

In this 13 step guide, we will walk you through the basics of PSLF and show you if it could be the right option for your situation.

We understand that sifting through all the information can be overwhelming, so we have broken down each step in an easy-to-follow format.

So if you are interested in learning more about PSLF and seeing whether it could work for your individual situation, keep reading!

Table of Contents

What Is Public Service Loan Forgiveness

Public Service Loan Forgiveness is an incredible option for college students and new grads looking to reduce the burden of paying back student loans.

If you have Federal student loans, you may be eligible for loan forgiveness if you’re employed by a non-profit organization.

This program offers debt relief on qualifying loans after 10 years of working in public service.

It’s an excellent way to ensure your loans don’t become a burden and that you can focus on your career goals.

What Public Service Loan Forgiveness Isn’t

PSLF is not a repayment plan! This is the most misunderstood portion of public service loan forgiveness.

Public service loan forgiveness is a feature of income-driven repayment plans.

The Basics of Public Service Loan Forgiveness

The public service loan forgiveness program was enacted in October of 2007 by President Bush. The purpose was to provide student loan relief to those working in the public sector.

Public sector means working at a non-profit or a government entity.

Under this program, your Direct Subsidized and Unsubsidized Stafford loans, Direct PLUS loans, and Direct Consolidation Loans can be forgiven. To be forgiven you must make 120 “qualifying” payments on your student loans.

Some important things to note:

- Submit proof of employment from an approved non-profit or government institution at the time you apply for forgiveness (a link to it is here). We highly recommend mailing one in every two to three months to track your eligibility and payment progress. This is especially true when you start working for a non-profit. This ensures you actually qualify for PSLF. Check out this article to see what happened to all those that ignored this basic advice.

- Fully employed means your employer’s definition of “full-time” employment. It is restricted to an annual average of 30 hours per week. Those working multiple part-time jobs who work at least an average annual of 30 hours per week also qualify.

- The 120 payments do not have to be made consecutively. Of course, it is in your best interests to finish them as soon as possible.

- Payments must be made under one of the Federal Income Driven Repayment Plans (“IDR”) programs to qualify. This is the most critical item and one of the big reasons people have gotten denied for loan forgiveness.

So When Does It Make Sense To Look Into PSLF?

Public service loan forgiveness is great for those attending expensive universities or graduate programs. Also, you’ll want to work in a non-profit job as well.

If your income is high relative to your Federal student loan amount, you do not qualify for PSLF. If you want to see if PSLF is right for you? Check out our public service loan forgiveness calculator.

Forgiveness Criteria

The income-driven repayment plans offers student loan forgiveness to anyone after 20 or 25 years.

The amount forgiven on the general forgiveness plans becomes TAXABLE income that you must pay taxes on.

However, under the PSLF the remaining balance of your debt is fully forgiven after 10 years of payments. In addition, there are no tax repercussions with PSLF.

Selecting The Right IDR Program

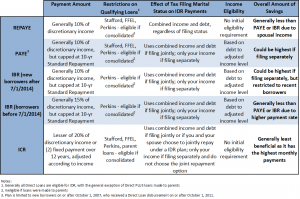

The first step is determining which IDR program your loans are eligible for.

- Federal Perkins Loans are loans made by schools.

- Federal Family Education Loans (FFEL) are Federal loans issued prior to July 1, 2010.

- Direct Loans are loans made by the U.S. Dept. of Education.

If your loans are ineligible for an IDR program, it may be possible to qualify by consolidating your loans into a Direct Consolidation Loan. Please refer to the table below for details.

The type of IDR plan that will be most ideal for you will depend on the following factors: (i) the type of loans you have; (ii) when those loans were taken out; (iii) your marital/tax filing status; (iv) your state of residence; (v) your household family size; (vi) your adjusted gross income; and (vii) the amount of debt you have relative to your adjusted gross income.

See how each of these factors influence your situation using the FitBUX calculator titled IDR Analysis. It is located on your FitBUX Profile under the My Tools section. Also, if you want to compare PAYE vs REPAYE, then check out this article.

How Much Could I Potentially Save?

Let’s consider an example. Assume you have $75,000 in Direct Grad Plus loans at 6.8% and $50,000 of Direct Unsubsidized loans at 5.8% from undergrad. You just landed a job with a non-profit and estimate that your adjusted gross income will be $75,000 (your AGI can be found on line 37 of your 1040 tax return).

Assume that you are single and have a household size of 1. To perform these calculations, I will use the Federal Government’s assumptions, including income and inflation growth.

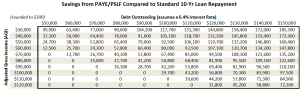

Assuming that your loans qualify for Pay as You Earn (“PAYE”), your total payments will be $74,500 over the next 10 years. Assuming you remain employed at a non-profit and make 120 payments you would save $95,000 relative to the standard 10-year student loan plan.

The table below provides a snapshot of the potential savings under a PAYE repayment plan and forgiveness under PSLF.

As a rule of thumb, public service loan forgiveness is beneficial if your aggregate federal student loan balance is greater than your AGI. The more student loan debt you have or the lower your AGI the more you can expect to save by participating in PSLF.

If you want to see a customized solution for your situation, be sure to check out FitBUX’s PSLF calculator.

The #1 Risk Of Public Service Loan Forgiveness

We have calls with FitBUX Members every day concerned about the viability of public service loan forgiveness.

People believe the number one risk of PSLF is the government not honoring it after 10 years. However, there is a bigger risk that we see every day.

People work at a non-profit for 2 – 4 years then quit. Instead of going to another non-profit job, they switch to a for profit company. Thus, they no longer qualify for public service loan forgiveness.

However, they are still on an IDR plan. Thus, they either have to prepare for the tax liability or switch to a student loan pay down strategy.

How Do I Reduce The Risk Of PSLF?

As I mentioned earlier, you have to be on an income-driven repayment plan to qualify for PSLF. Therefore, to reduce the risk you must assume you are not going to qualify for public service loan forgiveness. This means, start preparing for the tax liability of the IDR plans as though PSLF doesn’t exist.

When you save for the tax then you put yourself in a good situation. For example, you get forgiveness after 10 years. Then you’ll have no more debt and a good amount of money saved.

If you stop working at the non-profit, you have money saved. Thus, you can decide to keep saving for the tax or switch to paying off your loans. If you decide to pay them off simply take the money you saved and throw it at your loans.

I’m in, What do I do now?

First and foremost, you need to download the PSLF certification form. The PSLF certification form is one of the only ways you can confirm that:

- Your employer qualifies public service loan forgiveness, and

- You qualify for it.

You’ll want to bring it to your HR department and complete it the first day of work.

The address to send the completed form is on the PSLF certification form. Submit it and your loans will be transferred to Fed Loan Servicing if they already aren’t there. Despite its name, Fed Loan Servicing is a private student loan servicer administrating the PSLF program. They are not associated with the Federal government.

Therefore, it is essential that you file this form immediately. You don’t want to be one of the thousands of people that didn’t qualify for PSLF loan forgiveness because you did something wrong.

In addition to filing it immediately, we recommend you do it at least annually. You’ll also want to file it immediately if you quit your job and begin working at a new non-profit.

Adjusted Gross Income and Why It Matters

Let’s go through an example and assume the following:

- You are a recent graduate and have a gross annual income of $75,000 at a non-profit.

- You have $100,000 in graduate debt at a 6.0% interest rate and you enroll in PAYE (Pay As You Earn).

As you think about your monthly budget, consider what steps you can take to optimize your savings.

Thankfully, the Federal Government doesn’t your $75,000 gross income to calculate your monthly payment for your student loans. Instead, your “discretionary income” serves as the basis for how much you will repay.

Your discretionary income is calculated as your Adjusted Gross Income (the IRS defines AGI as “gross income minus adjustments to income”) less 150% of the poverty guideline income based on your household size.

In simpler terms, the lower your AGI, the lower your monthly payments will be.

Meaningful Things That Lower AGI

Below is a list of items that will reduce your AGI.

- Contribute to a Health Savings Account (“HSA”). In 2016, the annual contribution limit is $3,350 for individuals and $6,750 for families. HSA contributions can be used for qualified medical expenses, such as co-pays, prescription costs, or deductibles. The great thing about HSAs is the unused balance can be rolled into the next year.

- Contribute to a 403(b) or a Traditional IRA. In 2016, the annual contribution limit is $18,000 for a 403(b) and $5,500 for Traditional IRAs for individuals under 50. There are multiple reasons why contributing to a 403(b) (i.e., the 401(k) equivalent for non-profits) is hugely beneficial. It will help to not only reduce your AGI, but also save for retirement. Furthermore, if your employer offers 403(b) matching contributions, you will reap the benefits of free money from your employer.

- If married, decide whether to file separately versus jointly on your taxes. Your marital tax filing status affects your reported AGI and can drastically affect your IDR amount. Consult with your tax advisor and compare your tax savings under both scenarios to see which makes sense for you.

To see the impact of how lowering your AGI can help, let’s assume that you are single and will contribute $10,000 to your 403(b) this year. Your AGI will be $65,000 ($75,000 – $10,000). Under PAYE, your initial monthly payment would be $393, saving you $717 per month relative to the $1,110 that would be owed under a 10-year standard loan repayment schedule (based on our assumed loan terms).

Other PSLF Items To Remember

- You have to be employed by a qualifying organization and make 120 monthly payments to qualify for PSLF. However, these 120 payments do not have to be consecutive.

- If you need to reduce your employment hours for any reason (such as going part-time to take care of children), see if you can find another part-time job at a qualifying organization to hit the 30 hour per week minimum requirement necessary for PSLF qualification.

- If you are a contract employee working at a non-profit you DO NOT QUALIFY for public service loan forgiveness. You have to be employed by the non-profit.

- You do not want to refinance your Federal student loans! If you have private student loans then you’ll want to check out our student loan refinance guide BUT ONLY FOR THOSE LOANS.

Conclusion

Public Service Loan Forgiveness can be a great way to reduce your student loan debt and save money over time.

It’s important to understand the nuances of PLSF, including what qualifies for forgiveness, how to calculate AGI, and other items you should know about before applying.

If you’re having difficulty with managing your loans or it seems overwhelming, reach out for help from professionals who specialize in this field.

At FitBUX we provide personalized advice on all aspects of financial planning related to student debt so that our members have the best chance at success when pursuing their dreams.

Contact us today if you need assistance understanding public service loan forgiveness or any other aspect of personal finance!

By: Edmund Lau, CFA and Joseph Reinke, CFA

[…] Public Service Loan Forgiveness – The Complete Guide […]