Human capital is different than financial capital and it is the most important asset for anyone between the ages of 10 and 40.

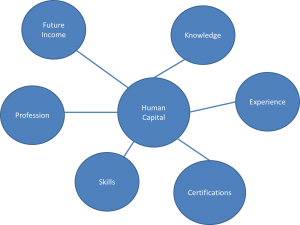

To begin, the dictionary definition of human capital is the stock of knowledge, habits, social and personality attributes, including creativity, embodied in the ability to perform labor so as to produce economic value.

In simpler terms, human capital is a combination of our future income and the risk to that income. Its important because it dictates everything we do financially, i.e. how we pay down student loans, should you rent or buy a house, how much insurance you need, investment allocations, etc..

In short, human capital is what sets you apart from others. Read on to learn more…

Human Capital Vs Financial Capital

Think about a technology business. Their largest assets are intangibles, i.e. their code, their technology, copyrights, patents, etc… In the long run, businesses realize the value of these things in the form of revenue.

Human capital is your intangible asset. However, instead of technology, copyrights, and patents, you have education, skills, and behavioral traits that have been developed over time. Also, instead of monetizing your human capital overtime via revenue you do so in the form of income. I.e. you recognize the value of your human capital over time in the form of income.

Analyzing human capital is one way you can determine trade offs between choices. For example, should you get an advanced degree such as your DPT or not. You can also see what professions have the best financial outlook for yourself based on the expected increase in human capital value.

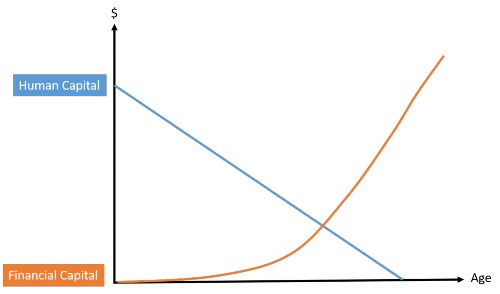

Financial Capital are assets you own that you can liquidate. For example, your bank account, your 401k, and your house. In the next section we discuss why human capital is so importance and what your long term goal should be.

The Importance of Human Capital

When I am helping new grad FitBUX Members with our new financial planning technology, they are often depressed. They have recently gone onto another company’s financial website and it tells them they have a massive negative net worth because all they have is student loan debt and zero financial capital.

However, this is incorrect because you do have a large asset, i.e. your human capital. (Side note: If you want to see what your human capital asset is worth and what your true net worth is be sure to build your free profile at FitBUX). Net worth should be calculated as Human Capital + Financial Capital = Net Worth

When you are young, your human capital is high. As you realize your human capital in the form of income your human capital decreases. For example, as of today you might have 30 more years of work ahead of you. Fast forward one year and you only have 29 years left. Thus, you will be collecting less in future income than the year previous.

With that in mind, your goal is to convert your human capital to income and turn it into financial capital as efficiently as possible. Next, I’ll discuss how your human capital plays a roll in your current finances and how to convert it efficiently to financial capital.

Human Capital & Financial Planning

The risk to your human capital is extremely important. Let’s look at two examples of how it plays a roll.

Example 1

You are 27 years old and are a real estate agent. Your income is 100% commission. Although you can make a lot of money, you can potentially be out of a job like many were during the economic contraction in 2008.

Therefore, your human capital is more risky relative to our next example. Thus, you would want to keep your financial portfolio more conservative, you’d need less insurance (life insurance), you’d most likely not want to buy a house (unless rent is stupid expensive), and if you have student loans you most likely would want to keep them as Federal loans and not refinance. (Side note: Before making decisions on student loans, you should chat with one of our expert student loan planners).

Example 2

Picture instead that you are a 27 year old physical therapist. PTs have very stable income and low unemployment. Therefore, you can be more aggressive repaying your student loans, potentially afford a more expensive house, and be more aggressive with your investments.

Most of our human capital is developed between the ages of 10 and 25 years old. From 25 years on, we begin to realize our human capital in the form of monetization. However, you should never stop developing human capital or you may find yourself obsolete. This was brought to the forefront in 2008. We consistently heard individuals in their mid 30s, 40s, and 50s saying they got laid off. Then they either could not find a job or they found a job at considerably less pay. That happened because they never continued developing their human capital and/or refining it.

What happens if you stop developing human capital?

We have a family friend that was an accountant for 20 years. When she started, the company kept their books by hand and she introduced what we consider an archaic accounting program on a computer (it was extremely basic and just added, subtracted, had a ledger, and could print). She thought that she was technically advanced, plus she was extremely skilled on a keyboard. All great human capital skills 20 years ago. However, as technology advanced, her skills stayed stagnant.

In 2010, she was making $110,000 a year with great benefits. That year the company was sold to a Chinese firm and the corporate operations where moved to China. She then found herself without a job. She began applying for accounting positions. She sent out over 100 applications and only a handful replied. The best offer she received was $48,000 a year working part time.

Two human capital traits that you can develop

For millennials, developing human capital is extremely important to set yourself apart from others. There are two human capital traits everyone can develop with an investment of time. The first is language. As the world continues to globalize, an American’s job competition is no longer other Americans. It is students from other countries that are just as smart but speak not only 1 or 2 languages but often times 3, 4, or 5 languages.

Another human capital skill I constantly hear employers complain about is communication. I hate to be the bearer of bad news but sending emails using texting language and twitter handles might work for your friends but not in business. Bottom line, be an effective communicator and you will automatically separate yourself from others.

How To Build A Financial Plan Incorporating Your Human Capital

Most traditional financial planners and investment advisors have no way of incorporating your human capital. However, you don’t need to stress. FitBUX’s new technology takes into account all of your finances which includes human capital and summarizes everything in one easy to understand score, your FitBUX Score.

All you have to do is go to FitBUX.com, build a free profile, and use our new financial planning technology. We say its like GPS for your money….

…And if you want to speak to a financial expert, you can schedule a free call with a FitBUX Coach.

By Joseph Reinke, CFA

Disclaimer: Nothing in this article constitutes financial advice. Each person’s situation is different. Therefore, you should build your free profile and use our free technology to develop a plan that is customized to yourself.

[…] of the primary components that sets FitBUX apart from other finance companies is the inclusion of human capital into our analysis of each client. As important as human capital is, a large disconnect exists […]